Smart Ways to Build Home in New Jersey within Your Budget

Building a new home is exciting yet challenging, especially for the first timers. Building a home within your budget limit needs a lot of effort, experience and research. And if you want to create wealth through homeownership then “Build equity”. What is build equity? It is the percentage of your home’s value that you own and it’s key to building wealth through homeownership. Prior building home equity you need to know how much equity do you have?

Calculating the equity is easy. When you buy your first home because it’s basically your down payment. For example, if you put $11,250 down on a $225,000 home, your down payment is 5% and so is your equity. According to the Inside Mortgage Finance, most of the first time home buyers in US started with about 7% equity from 2016 to the first quarter of 2018. The situation is quiet encouraging for the buyers as they don’t need to spend years saving for 20% down or more before buying. Repeat home buyers started with more equity, at about 17%.

Smart ways to build equity: We will tell you six smart ways your home can create wealth for you.

- LET YOUR HOME APPRECIATES: This method of building equity can take a little time or a lot, depending on the market. Appreciation has been a boon for many home buyers as home prices going up in recent years. Median home value grew from $185,000 in April 2016 to $216,000 in April 2018. It means if you bought a home for $185,000 in April 2016 with a down payment of $12,950 your beginning 7% equity would have grown to 23% by April 2018.

- MAKE A LARGER DOWN PAYMENT: Another smart way is to pay large down payment. You can do this but in many cases we have seen that waiting to save extra cash can go against your broader financial interests, if you lose a chance to build equity through appreciation. Thus, it is necessary to strike a balance among monthly budget, down payment and savings for other urgencies. Every good mortgagee can provide rate and market insight to help you do this.

- USE FINANCIAL WINDFALLS: Handle your payments wisely, take advantage of family gifts, work bonuses and inheritances to pay down your mortgage. If you pay down payment in lump sums, see if your mortgagee will recalculate your payment based on the new, lower balance.

- MAKE BIWEEKLY PAYMENTS: A smarter way to build equity is to make mortgage payment every two weeks instead of once a month. Over the course of year, this will add up to 13 monthly payments instead of 12. In this way you will be able to build equity faster and shave five to six years off a 30 year mortgage. Just ensure that your lender isn’t charging extra for processing semimonthly payments.

- CUT YOUR LOAN TERM IN HALF: Cutting your loan term in half is another very useful technique. Take out a 15 year mortgage instead of a 30 year mortgage, and you will build equity twice as fast. Two stipulations that you need to be careful about are: you will have a significantly higher monthly payment and because of that you may have a tougher time qualifying.

- MAKE HOME IMPROVEMENTS: Only big improvements like new kitchen or additional bathrooms or other rooms will add meaning full value. New appliances or cosmetic features like paint are unlikely to increase value. Make sure the cost of such improvements will create the added value you are looking for.

HOW TO USE YOUR EQUITY?

To use your equity you must borrow or sell your home. the three most well-known ways to get to your equity through borrowing are a home equity line of credit (HELOC), cash-out refinance or home equity loan. Before using compare the pros and cons of each.

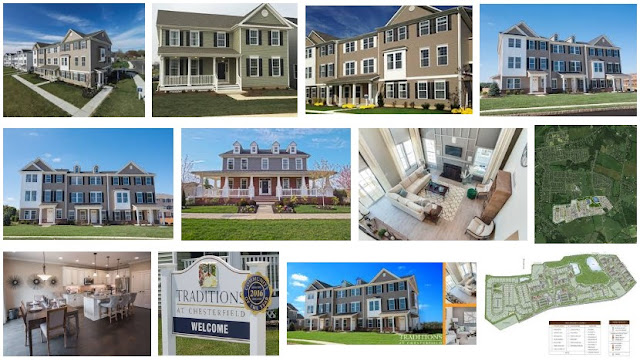

Read More-->> New Homes Burlington County | New Homes Mercer County

Comments

Post a Comment