Earn more from the investment properties located in Burlington NJ

When we talk about earning more from real estate investment properties in Burlington NJ, there is no long list of ways to do it. With limited number of options it is necessary for investors to be master in whatever the way they choose, in order to get success. Just because the concepts are simple doesn’t mean they can be easily implemented and executed. But it doesn’t mean you can’t earn more with investment properties. Be ready, as an experienced real estate investors in Burlington we are going to share the basics of real estate and how successful real estate investors work to maximize their earnings.

There are primarily three ways investors make money from real estate. Firstly, earn when property value increases, profits generates from business activity depends upon the real estate and from rental income collected by leasing out the property to tenants. Besides these major ways there are some other ways to make money from directly or indirectly profits such as learning to specialize in more esoteric areas like tax lien certificates. The above mention concepts account for a vast majority of the passive income and ultimate fortunes that have been made in the real estate industry. Let’s have a detail idea about each three primary methods of earning more from real estate investment properties.

1. Earn From An Increase In The Property Value: Real estate market can fluctuates any time, so keep in mind that property values do not always increase. The solid evidence of this is the market collapse of 1980s and 1990s and 2007-2009 in real estate history. In fact, property values rarely beat inflation in many cases. For example, if the price of property you own is $500,000 and the inflation is 3 % and your property sells for $515,000, in numbers you earn $15,000 more but you are not richer than you were last year. Why? Because the addition wasn’t real but was nominal. All this happens because the government has to generate money when it spends more than it takes in through taxes. Over time, everything else is equal which means each existing dollar losing its value and become less worthy than it was in the past.

One of the most effective ways that successful real estate investors use to make money is to take advantage of a situation. Simply they made odds in their favor! When inflation rate is expected to exceed the current rate of long-term debt, they find people who are willing to gamble by acquiring properties, borrowing money to finance the property and then they wait for inflation to increase. This is how they can pay off their mortgages with worthless dollars. This signifies a transfer from savers to debtors. The trick is to buy when you think a particular piece of land will someday be worth more than the present cap rate alone indicates it should be or when cyclically adjusted cap rates are attractive. Successful real estate hunt the right project at right time and at the right price to create future rental income, as they understand economics, market factors and consumers.

2. Earn More From Rental Income: It is our common concept that collecting rent is the simplest way to earn in real estate. If you own any real estate investment property you can put it on rent. How simple is that, but it is not easy as it seems. Maintaining these properties is a difficult task in itself. If you own rental house or apartment building, you might have to deal with issues like broken toilets and clogged sinks. Owning industrial warehouse bring risks of environmental investigations for the actions of the tenants. Hence, real estate investment is not an easy as it look. But the good news is that there are some available tools that make comparisons between potential investments easier. A special financial ratio called the Cap rate or capitalization rate is one of them, which will become invaluable to you on your quest to make money from real estate. For example if your property makes $100,000 per year and sells for $1,000,000, divide the earnings by the price tag and earn an expected 10 % on your investment, in case you paid entirely in cash and no debt. Rental income is considered best as it has a margin of safety that protects you during collapses.

3. Earn From Real Estate Business Operation: Making money through this way involves special services and business activities. Small activities and additions to your property is also a source of earning. For example, if you own an office building you can make money from vending machines and parking garages. You might sell on-demand movies to your guest if you own a hotel. These types of investment require sub-specialty knowledge. You can do this own your own or can hire a specialist in this field. The opportunity to make money can be endless for those who rise to the top of their field and understand the intricacies of a particular market.

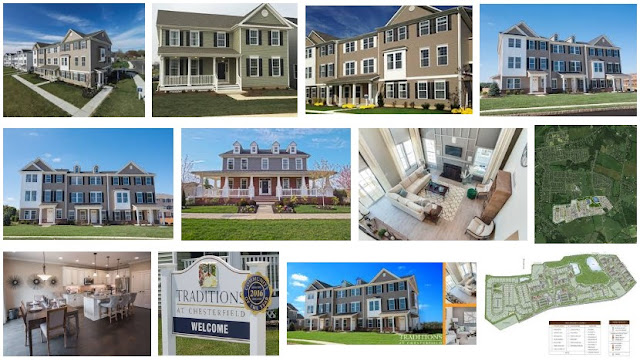

If you’re looking for best investment opportunities in real estate in Burlington County, NJ contact Traditions at Chesterfield to get best investment opportunities at premium location and on very affordable prices. Our professional team will guide you on every step of buying or investing for your smooth and tension free process. Experience the finest transaction with NJ’s renowned home builds community.

Comments

Post a Comment